This article was originally published in the Body Care Trend Report. Receive your copy here

When did body care get so buzzy?

Whether it’s #Showertok and the #everythingshower elevating consumers’ body wash regimens or active-packed, clinically-backed treatments that deliver serious skin care results below the neck, the category is commanding enviable attention from both consumers and brands.

Body care is currently one of the most dynamic categories in beauty.

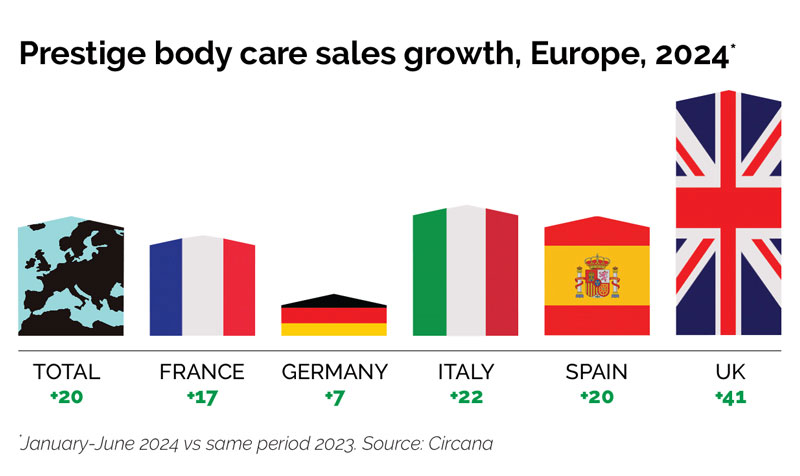

It is outperforming the wider skin care market, with value growth of 20% across the premium segment, according to Circana’s Europe data from January to June 2024.

And while price increases have fuelled growth to an extent, the rise in unit sales by 6%, reveals strong demand from shoppers too.

The category has in fact been on the rise since the Covid period when there was a surge in body care products as consumers indulged in self care rituals when they spent more time at home.

“Ever since then, it has been a main focus for consumers,” says Circana’s Director of Beauty Europe, Mathilde Lion.

“Consumers are no longer just focusing on the face, they are looking for performance within categories that they were investing less in before, such as hair care and body care.

“They are looking for specific ingredients as they focus on their body skin concerns, whether that’s to address signs of ageing or issues such as pigmentation.”

“Body care is hot right now,” agrees Tina Randello, Chief Commercial Officer at skin care brand Alpha-H.

“Traditionally body care has focused on hydration and the softer side of skin care – sensorial benefits.

“But over the last few years requests for functional body care have topped our customer interests.”

According to Mintel, over a fifth of US consumers say they are paying more attention to their purchases in body care compared to a year ago, while 33% of body care shoppers believe it’s worth paying more for added skin health benefits.

The impact on body care innovation has been clear, with product launches zoning in on delivering specific skin benefits, and brands from elsewhere in beauty moving in.

Fast-growing skin care brand Byoma introduced Byoma Body, focusing on brightening, hydrating, nourishing and smoothing benefits as well as products for sensitive skin.

And Selena Gomez’ make-up brand Rare Beauty launched its first body care range Find Comfort, that includes a Hydrating Body Lotion that immediate hydrates and brightens dull skin over time.

Body care is hot right now - Tina Randello, Chief Commercial Officer, Alpha-H

Innovation has also soared in body wash products as consumers consider the benefits of using products that improve skin health and protect the skin's barrier.

Kayla Villena, Head of Beauty & Personal Care Research at Euromonitor International says: “With hero ingredients well established in the adjacent categories of skin care and hair care, players in the wider beauty and personal care industry have been applying their expertise to develop body wash offerings that include skin-forward formulations and formats that mimic premium practices.

“We see this with the inclusion of ingredients well known in facial care appearing in launches of body wash/shower gel, like niacinamide, hyaluronic acid, AHAs, BHAs, probiotics and salicylic acids.”

Brands that build an emotional connection, offer a unique experience and bring a sense of fun are also thriving.

Australian brand Sundae Body, known for its collection of whipped scented shower foams, has expanded and grown rapidly in 2024, launching into the UK with Boots and the US with Walmart.

“We’re tapping into the desire for products that not only perform well, but also bring joy to the everyday,” says founder and CEO Lizzie Waley.

“That emotional connection, combined with our innovative formats and stand out packaging, has led to strong repeat purchase rates and brand loyalty.”

Shifting consumer demands across body care are changing not only who is playing in this segment, but how brands play in this segment.

As body care continues on this journey, new trends are emerging, overlooked opportunities are being rediscovered, and brands who can capitalise on meeting consumers’ evolving needs are ripe for the ride.

Trends will be revealed in detail throughout November exclusively to subscribers, so don't miss out and subscribe.

Trend 1: High performance body care

As 2024 draws to a close, still the body care boom continues, and demand for transformative, high performance body care is soaring.

Alongside this evolution, consumers are now expecting more. “With an increase in body care products that are multifunctional and offer support with body conditions, there is more expectation around results and quality ingredients,” says Julia Barcoe-Thompson, co-owner of online beauty retailer Face the Future.

“Customers are looking for miracle creams – home care body products that will achieve the same as in-clinic treatments and help with body concerns such as pigmentation, scarring and body acne.”

This trend explores how body care products that offer clinical-grade efficacy, similar to that seen in facial skin care, have become the new gold standard for savvy consumers.

Trend 2: Hand and nail care's high-tech revival

Hand and nail care is on the brink of something big.

It may have been one of beauty’s most overlooked categories, but with many consumers spending more time and money on manicures, and awareness of hand skin changes such as crepey skin and pigmentation is growing, there is an opportunity for treatments that address the health of the skin and nails.

Now, a series of breakthrough innovations are entering the market as brands recognise the potential that new clinically-driven, result-based products could bring to the space.

From new, performance-led hand and nail care brands including Habelo and Tinexyl to levelled-up launches from OPI, Soft Services and Joonbyrd, this trend takes a look at the innovations that are giving hand and nail care a high-tech spin.

Trend 3: Fragranced body care's 'skinification' makeover

Whether it comes down to the #PerfumeTok effect or the meteoric rise of scented body care giant Sol de Janeiro in the sector, fragrance has come back to body care with a bang.

In recent months, some of the biggest names in beauty, such as Augustinus Bader and Deciem, have stepped into scented body care, despite having gained a reputation for championing fragrance-free, performance-focused skin care.

Meanwhile, for perfumed body care brands the opportunity is to overhaul their ailing ancillary lines.

Traditionally, ancillary products rely solely on the star fragrance for their appeal, but for today’s consumer, that is simply not enough to win a sale.

The ‘skinification’ of body care has moved the segment on, and brands that answer this by building premium skin care benefits into their perfumed body care lines could appeal more to consumers.

Trend 4: Premium body care is the next M&A target

Body care has stepped up to become the most dynamic segment in premium skin care, but it’s not just consumers that are splurging on the skin beneath their chin.

This high-growth segment is also increasingly attracting investment and acquisition interest, which is poised to continue into 2025.

L Catterton’s majority stake acquisition of premium bath and body care company Stenders in September signals the interest sweeping the sector, a move that followed e.l.f. Beauty’s US$355m acquisition of high performance skin and body care brand Naturium last year.

This trend explores what the sector’s M&A potential is for 2025, and which brands could be on investors' radars.

Trend 5: Body shimmer oils

Named one of 2024’s biggest body and wellness trends by online retailer Beauty Pie, body shimmer oils have been sliding into the bestseller rankings for more and more beauty brands this year.

Having experienced a 158% spike in Google searches during a six month period to November 2023, growing consumer interest in shimmer oils has propelled brands to take a closer look at how to build out the segment and capitalise further on the appeal that the product has.

Traditionally used and promoted as a seasonal summer product that enhances the appearance of a golden tan, consumers are no longer shelving shimmer oils when the warm weather subsides, and brands have spotted the potential that this offers.

Now, new launches from the likes of Chanel, Nuxe, Ellis Brooklyn and more, are extending into the cooler winter months, and the festive season provides an especially bright focus.