It spent much of the past decade in the shade, but following economic recovery and falling unemployment, Spain’s cosmetics and toiletry market produced a more stable set of results in 2015, and in 2016 finally returned to growth.

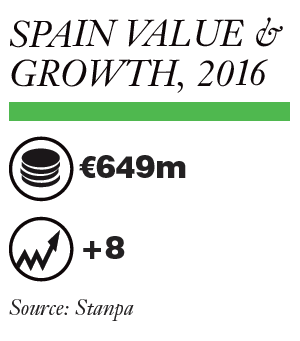

And the biggest winner was colour cosmetics, with sales of this category increasing by an impressive 8% as Spanish consumers spent €649m on make-up, according to figures from Stanpa (Asociación Nacional de Perfumería y Cosmética).

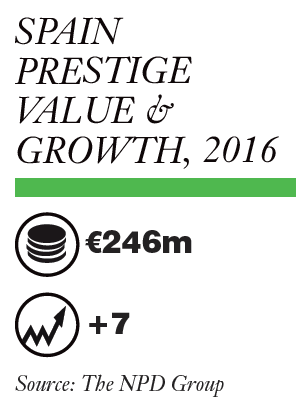

Prestige sales were strong in 2016, rising by 7% to €246m notes The NPD Group, and while a slightly lower level of growth of 5% was recorded for the first half of 2017, the category remains robust.

Spain: Prestige colour cosmetics market sectors, 2017*

‘All other face’ includes primers, highlighters etc. First half of 2017. % value growth. Source: The NPD Group

“The performance is linked to the health of the Spanish market,” Mathilde Lion, Beauty Europe Industry Expert at NPD, tells Cosmetics Business.

“Since the end of 2014 we have seen a strong recovery across all categories, especially fragrance and make-up.

"Local demand has recovered, while Spain has also benefited from strong tourism, so we have seen this impact some of the big cities such as Barcelona and Madrid,” adds Lion.

“Spain in general is an attractive country to shop in as prices are lower than other countries.”

With greater disposable income, Spaniards have been able to indulge in their love of make-up.

According to a survey by Birchbox in July 2017, 67% of Spanish women wear make-up every day, with 45% spending more than 15 minutes a day applying it.

Mascara stands out as the product that most women – nine out of ten in fact – have in their makeup bags.

However, for 74% lipstick is another favourite and seven in ten own blusher.

Launch highlight: Lancôme Matte Shaker

Matte lipstick has been a major global beauty trend

over the past couple of years, and one brand that

benefited from innovating with a dedicated line to

create this look is Lancôme with Matte Shaker.

The product became the third biggest prestige

lipstick launch in Spain between January and

June 2017.

With a long lasting

liquid formula that turns matte

after a few minutes, the

lipstick, which is available in

seven shades, is said to

have an intense colour

payoff, creating a bold, lip

stained look.

Enriched with

silicone oils, the formula is

also non-sticky and feels

light, and it comes with a

precise lip cushion applicator

to make it easier to apply.

Lipstick shines on

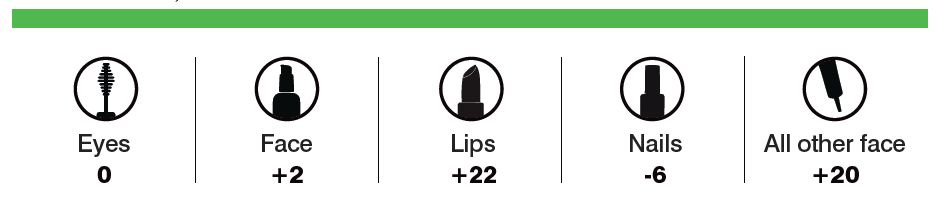

However, in terms of sales, category growth is mostly coming from lipstick.

In 2016, 17 million lipsticks were sold, driving growth of 12%, according to Stanpa.

And for the first half of 2017, prestige lip products grew by an even more dynamic 22%, according to The NPD Group, mainly due to lip colour which climbed 28%.

According to market experts, the growth of this segment is partly due to the global popularity of lip make-up on social media networks and the craze for pouting selfies by celebrities.

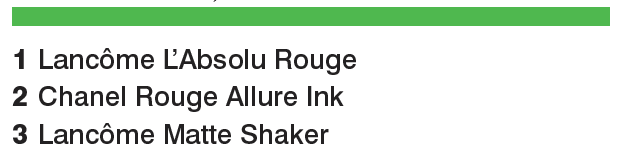

Spain's top prestige lip launches, 2017

January to June 2017. Source: The NPD Group

And Lion adds that there are further factors that have contributed to the rise of lipstick.

“There has been strong innovation in lipstick with a lot of new colours and textures, and new segments growing like matte lipstick.

"Brands have also invested a lot of communication in lipstick. The growth is coming from both new innovations and existing lines.”

Some of the most successful prestige lipstick launches of the past year include Lancôme’s (L’Oréal) L’Absolu Rouge and Matte Shaker (see Launch highlight) and Chanel’s Rouge Allure Ink, according to NPD.

Lipstick innovations are well received by Spanish consumers, says Núria Ollé PR and Communications Manager at Birchbox.

“As we have seen in the [Birchbox] study, 74% of Spanish women have revealed that lipstick is one of their weaknesses and in truth there is a great variety of tones, colours and textures, so women can never have enough.

"Thanks to this great variety, lip make-up can be adapted to the different preferences of each woman; a pink tone for spring, a nude for daytime or an elegant burgundy for a night out.

"There is a lipstick for every occasion and for every mood, so it is difficult not to find an option that you like.”

NPD figures reveal that other categories within the prestige make-up segment grew at a much lower level compared to lipstick in the first half of 2017.

Nail polish declined by 6% – although this is not a new trend for this sub-category, with many other countries recording similar or even greater losses – face make-up grew by 2%, mainly driven by foundation which grew by 4%, but eye make-up was flat.

“Eyeshadow is a big segment, yet it is not recording any growth in Spain,” says Lion.

“However, there are no major concerns overall as the make-up market continues to grow and there is room for brands to succeed.

"Indeed, one further segment that is performing well is what we call ‘all other face’, in which we find products that are linked to new trends, such as primers, highlighters and multi-use lip and cheek products.

"It is a smaller segment but it grew by 20%.”

Innovative launches continue to fuel this segment, such as YSL Encre de Peau All Hours Primer (L’Oréal), a lightweight skin perfector that evens skin tone and creates a soft-focus effect while helping make-up to go on smoother and last longer.

And Urban Decay (L’Oréal) launched its cult-favourite Eyeshadow Primer Potion, which is designed to prevent eyeshadow from creasing while boosting colour intensity, in a range of new shades, including Caffeine, a rich brown matte finish, and Sin, a pink champagne colour.

Meanwhile, Fenty Beauty (Kendo/LVMH), the new range from Rihanna, launched Pro Filt’r Instant Retouch Primer that claims to smooth away the look of pores, even skin tone and texture and absorb shine while creating a “filter-like blurring effect,” according to the brand.

The release of Fenty Beauty in September, a line of 91 references including 40 base shades of foundation, was marked by a promotional stop by Rihanna at a Sephora store in Madrid.

The line is likely to perform very well in Spain, since, says Ollé, “Spanish women look for inspiration from American influencers related to the world of fashion, beauty, cinema and TV series but also with those created by social media.”

She notes that women also look to beauty, clothing and lifestyle products created in the US and UK for inspiration.

Brand spotlight: 3INA

Global colour cosmetics brand 3INA (pronounced ‘mina’) is manufactured in

Spain and launched in its domestic market this year at department store chain

El Corte Inglés.

Cosmetics Business speaks to 3INA about the brand’s latest

developments in Spain

How has 3INA been performing in Spain since launching?

Customers seem to love our unique approach to beauty and bold, playful

colours.

We were very excited to launch two new 3INA spaces in July, including

one in Madrid, at department store giant El Corte Inglés, and we have more

openings coming soon.

What are the latest developments for the brand in Spain?

As newness is one of the unique aspects of our brand we roll out new launches

on a monthly basis.

Our latest is a range of six new Ultra Mascaras that include

a hydrating Lash Primer, a Lash Tint for an instant darkening effect and new

mascaras for lengthening, curving and volumising.

There’s one for every mood.

What key make-up trends have you seen in Spain

this year?

Bright colours and holographic effects with a futuristic,

space-age feel.

We’ve seen this not only in Spain, but in

other markets as well.

We’re setting matte finishes aside

for a world of pearlescent shines and dazzling hues.

Shaking up make-up

3INA (see Brand spotlight) is another disruptive brand that burst onto the scene in Spain this year, launching with the aim of challenging the one-size-fits- all definition of beauty with “confident aesthetics and a positive, inclusive attitude”.

The brand, which aims to be empowering and enhancing, has a fast launch pace, with limited editions and seasonal collaborations, enabling 3INA to pick up on trends as they break.

Lifestyle-led brands have an opportunity in this market. Consider formulas for active women that include cooling and long lasting properties

Lion notes that such make-up brands, which have a strong presence on social media, are changing the course of the market.

“We have seen the entry of newcomers that are shaking up the category and disrupting classic colour cosmetic brands.

"We are in a market that is moving very fast and is focused on new kinds of brands,” she explains.

Lion notes that there are brands that, like Fenty Beauty, already have a wide range of foundation shades, but that a response to the focus on diversity is now necessary.

“Brands have to react to what is happening in the market,” says Lion.

And Ollé believes there are further opportunities for new brands in this market.

“There is a growing interest in niche or ‘indie’ cosmetics brands, and brands that are segmented by lifestyle, rather than by physical traits or age, for example make-up for active women, or people who spend the day travelling.”