Market overview: At a glance

What's in this report?

Introduction

Top 5 trends:

1. The 'skinification' of hair

3. Inclusivity

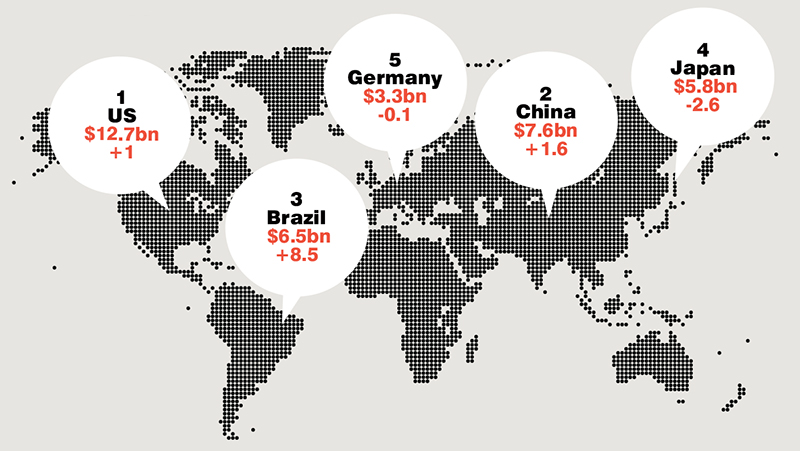

Global top 5 largest hair care markets, 2017

Key market challenges addressed

The global hair care market has struggled to replicate the same kind of dynamism that other beauty categories, such as skin care and make-up, have seen in recent years.

Euromonitor International notes that “hair care was slow to adapt and struggled to remain relevant,” as longer term shifts in mindset and priorities begun to take hold among consumers, while manufacturers sought to catch up with the vigour elsewhere in the beauty market.

Nevertheless, consumers have continued to add to the list of demands they expect hair care brands to meet, and as 2018 has marched on, it is clear to see that the challenge has been accepted. More brands, including an array of young niche brands, are refreshing the space by rising to cater to hair concerns for all textures and types, syncing with consumer lifestyle choices and responding to individual needs with customised solutions.

"Brands have begun taking on an innovative approach to formulation, delivery and experience in order to turn the future of hair care around,” says Sarirah Hamid, founder of Pretty Analytics.

The return of a more healthy category can be seen in the UK, which has experienced a u-turn in sales. Kantar Worldpanel data shows that while hair care declined by 4.5% in the year to May 2017, the year ended June 2018 saw a 2.8% rise to £1.2bn. And globally, hair care sales in 2018 are expected to rise by 5% to total an estimated $78.9bn, according to Euromonitor International.