Report introduction: At a glance

What's in this report?

Introduction

Top 5 trends:

3. Scents of modern masculinity

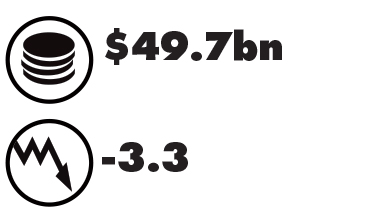

Global value and growth, 2020

Source: Euromonitor International

Key challenges addressed

For a category that had been forecast to grow by a spritely 2.7% in 2020, men’s care suffered a disappointing blow. Changes in demand and shopping behaviour generated by the impact of the pandemic on consumers’ daily lives has shaken up the sector and left sales to fizzle out.

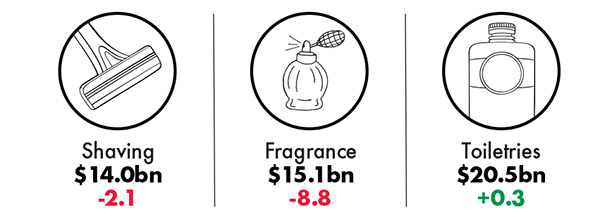

According to Euromonitor International, men’s grooming products declined by 3.3% to total $9.7bn globally. Losses were significant across men’s fragrances (-8.8%) and shaving products (-2.1%) while men’s toiletries were flat.

Global men’s care sectors, value and growth, 2020

Source: Euromonitor International

Will King, founder of King of Shaves, explains: “The EPOS/IRI data I have seen across all men’s categories of grooming, styling, shaving, skin care shows that they declined as product consumption declined, with people simply not ‘going out’ and therefore not needing to ‘prepare’ to go out or go to work. Skin care has been less affected than shaving, while discretionary items such as styling and ‘cosmetic’ effect products were down.”

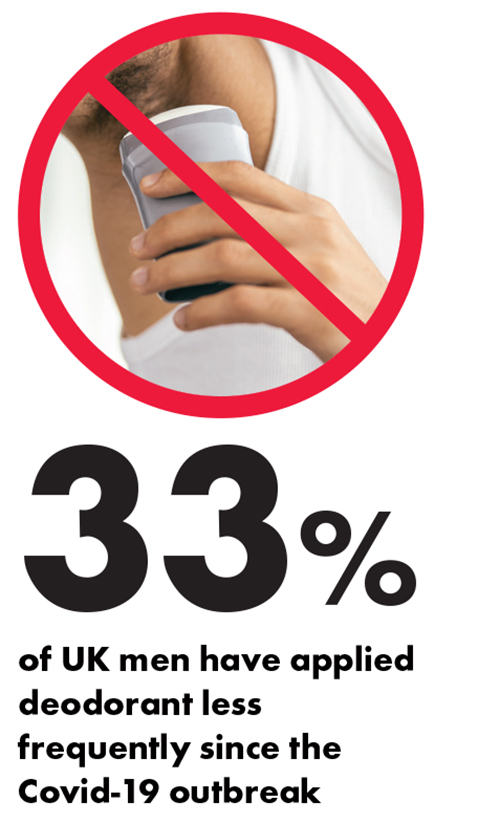

Source: Mintel

As a result, men’s routines overall became simpler, with fragrance and shaving occasions in particular declining or disappearing completely. Research from Mintel reveals that men’s deodorant use has also plummeted: 33% of UK men have applied deodorant less frequently since the outbreak.

Matt Maxwell, Strategic Insight Director at Kantar, says: “Men are not necessarily as concerned with their looks as they would be normally if they were going out, seeing friends and going to work.”