There are many signs to indicate that the male grooming market is poised to enter an exciting phase, but industry experts agree that we are not quite there yet. Compared with female consumers, a majority of guys are still reactive, not proactive buyers – which means they shop for solutions to immediate problems, rather than looking for preventative products, and this is hampering growth a bit. But millennial consumers are eschewing gender expectations, offering hope for a lucrative future.

According to Euromonitor International, the global male grooming market is expected to be worth US$50.39bn in 2016 in current prices, an increase of 6.8% on 2015’s total of $47.19bn. Growth is being spurred, however, by consumers in emerging markets in the Middle East and Africa (12.7%), Latin America (11.1%) and Asia Pacific (8.2%). In Western Europe, the men’s market is slated to grow just 2.2% – a rate slower than the estimated 2.5% overall beauty and personal care growth in the region.

Moreover, in 2015, in the UK – one of Europe’s most mature men’s markets – analyst group Mintel actually noted a slowdown in the male grooming category growth rate. This, says Mintel’s Senior Beauty Analyst, Charlotte Libby, is because (in the skin care segment at least) men are not expanding beyond the basics.

“There is limited awareness, compared with the women’s market, around things like SPF protection in a moisturiser, anti-ageing benefits and exfoliation,” she tells SPC. “They’re not on men’s radars yet – it’s more about keeping skin hydrated and energised.”

Growth is also being flattened due to a lack of uptake of targeted products for different facial zones; for example, those for the eye area, adds Libby.

However, the most recent data from NPD Group suggests that 2016 was a more positive period for male grooming sales in the UK. During the January-October 2016 period, while women’s skin care flatlined, the men’s market grew by 2.7%.

Teresa Fisher, Senior Account Manager, UK Beauty at NPD, cites three main reasons: an 8.3% growth in ‘treatment shaves’; a spike in the launch of male-specific hair care; and greater demand for male grooming kits, something Fisher says “works even better for men” than for women, as it reduces the “need to educate them on separate products”.

Under the beard

Mintel’s Libby suggests that another factor contributing to 2015’s lacklustre men’s skin care performance was the beard trend.

With men displaying less of their face, “they may have less of a desire to use facial skin care products”.

“The beard phenomenon will continue in as much as guys will continue to use facial hair to shape their face and to personify themselves." Nick Ferguson, Director of Men’s Skincare, The Estée Lauder Companies

Commenting on this segment of the market, Nick Ferguson, Director of Men’s Skincare at The Estée Lauder Companies, says that while “close to 50% of men in the UK have facial hair…there are predictions as to the way that’s going to go now”.

While he notes that there might be a “backlash against the whole hipster identity” and therefore the full beard associated with this demographic, men are unlikely to return to last decade’s clean-shaven look. Today’s men realise that “they no longer need to shave every day – it’s no longer something that’s expected of them”.

Ferguson adds: “The beard phenomenon will continue in as much as guys will continue to use facial hair to shape their face and to personify themselves. And, from a product perspective, they’ll be looking for products that provide more precision, ones which help them with shave irritation and also help them look after both the beard and the skin underneath the beard.”

The new Clinique for Men 2 in 1 Skin Hydrator & Beard Conditioner, from Estée Lauder-owned brand Clinique, does exactly this, aiming to improve skin while softening the beard.

In fact, 2016 saw several brands best known for their skin care know-how extend their expertise into the beard category. L’Oréal’s Kiehl’s launched Grooming Solutions Nourishing Beard Grooming Oil, containing pracaxi oil and salicylic acid to condition hair and to treat the skin underneath, while Bulldog Skincare, which was acquired by Wilkinson Sword- owner Edgewell only last month, introduced full Shave and Beard ranges at the beginning of the year.

Bulldog co-founder Simon Duffy says that not only is Bulldog bucking the UK’s sluggish overall skin care sales trend, but that its skin care origins give it an advantage when formulating skin-friendly beard products.

“If you take our beard oil, people are using it primarily to tame, soften and moisturise the beard. But the aloe, camelina oil and green tea are also great for the skin that sits beneath the beard,” he tells SPC.

“That’s what you get a lot of men complaining about – that the skin beneath the beard gets itchy, red and flaky.”

Mintel’s Libby agrees that, in future, male consumers will focus more on what lies beneath the beard, opening doors wider still for hybrid skin and facial hair products.

“While we say the [beard] trend is dying out and it’s not going to be as big a focus, we don’t think it’s going to return to how it was treated by the industry before this,” she explains.

“It’s no longer a choice between clean-shaven and having a full beard. Brands have identified that it’s about all levels of facial hair, which may differ day-to-day or seasonally. We’re going to see a lot of products focusing on stubble and different lengths of facial hair.”

She believes this will encourage men to look more closely at their skin health in the context of sporting facial hair, for example, ingrown hairs or congestion: “It will help the industry talk to men about what their skin needs, as well as their facial hair.”

Body & bath

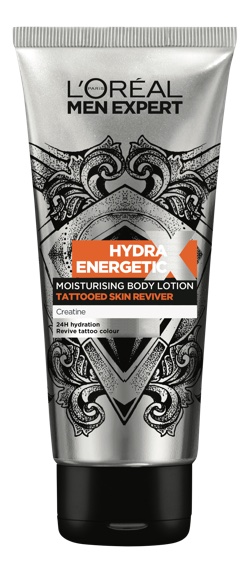

Closely related to the fashion and lifestyle movements associated with beard wearing, body care for tattooed skin went mainstream in 2016. This year, Captain Fawcett Limited introduced a Tattoo After Care Salve for the freshly inked, containing the anti-inflammatory and antibacterial ingredients flame tree and snake vine to calm, moisturise and assist healing. A big October launch from L’Oréal Paris, meanwhile, was Men Expert Hydra Energetic Tattoo Reviver Lotion, claimed to prevent loss of vibrancy and definition in those with already-healed tattoos.

Also influencing the body care market, as well as the bath and shower one, is the rising number of (typically young) men who are embracing an intensive gym regime as part of their physical upkeep. For the beauty and personal care industry, this relatively new tribe has encouraged an uptick in the launch of solutions aimed at men post-workout.

“Young men are vey impacted by the health and wellness trend, male fitness models and ‘gym selfies’,” says Libby. “There is, of course, a negative side to this related to body image, but the personal care industry has responded well in terms of product innovation. You’re more likely to get muscle soaps and detox baths for recovery, and caffeine products to wake you up.” There are also bath products offering extra deodorising efficacy for guys who’ve worked up a sweat, like Mr. Natty’s Pioneer’s Soap containing pine for its natural antiseptic and deodorising properties.

She notes that men are more likely to bathe than women, not for pampering purposes, but for recovery after sport.

Libby also cites the health and wellness trends as being behind the boosted use of superfood ingredients, such as kale, broccoli and charcoal (often consumed as ‘activated charcoal’) in male grooming products.

Likewise, from-the-earth ingredients, such as the ‘natural lava rock’ used in Jack Black Turbo Body Bar Scrubbing Soap or clay in hair care products, hold particular appeal for men, but are also non-gender specific enough to work in unisex formulations.

Millennial men

While the beauty and personal care industry should beware of fetishising specific demographics excessively, it is safe to say that millennials are influencing and will continue to influence overarching trends within male grooming.

They are, for example, leading the charge when it comes to an intensifying appreciation of fragrance. “Millennials are non-judgemental,” notes leading fragrance expert and co-founder of The Perfume Society Lorna McKay. And when it comes to fragrance, they are “looking for the latest, the greatest, the new [and] the different”.

She tells SPC that is no longer just wealthy male consumers looking for unique fragrances. It could be anyone who simply “doesn’t want to smell like their mates”.

Men are also braver now about the intensity of the scent they wear, which McKay says is reflected in a greater launch rate of eau de parfums (edp). “They’re more proud to wear their fragrance,” she explains, “and sometimes an eau de toilette doesn’t cut it.”

McKay flags up Tom Ford’s Private Blend Ombré Leather 16 and Vert Des Bois fragrances, Beaufort London’s Fathom V and Juliette Has a Gun’s Into the Void as examples of recent masculine edp launches.

The Perfume Society, a website for fragrance aficionados which launched two years ago, introduced its first male ‘discovery box’ (a monthly fragrance sampling service) this summer, called ‘The Scent of a Man’, which was followed by ‘The Scent of a Gent’ in October. Both collections have been selected to help men discover which fragrances they like.

In addition, The Perfume Society offers various workshops, which have received a lot of attention from male subscribers, according to McKay. “One of the benefits of being a VIP subscriber to The Perfume Society is that you’re invited to improve your sense of smell – and we’ve got more and more men signing up,” she says. “They love the idea of training their nose,” she adds, likening it to wine tasting.

“We’re seeing a slight shift in popularity towards unisex in the niche cologne-style fragrances among both men and women that is heavily influenced by the new gender fluidity across fashion and music.” Charlotte Libby, Senior Beauty Analyst, Mintel

There has also been a surge in demand for unisex fragrances. As Libby tells SPC: “We’re seeing a slight shift in popularity towards unisex in the niche cologne-style fragrances among both men and women that is heavily influenced by the new gender fluidity across fashion and music.”

There’s less need to stick a man in the ad, or use dark packaging, she stresses, “it’s more about the scent and what it means to you”.

When it comes to skin care, NPD’s Fisher says she is “seeing more in terms of formats and textures that are tailored to millennials, or younger consumers”, for example, gel formulas, which work better for young men whose skins might be more prone to oil.

Products for oily skins of all ages were certainly in vogue in 2016. Lab Series introduced MAX LS Matte Renewal Lotion, which delivers hydration without the shine, while Bulldog also launched an Oil Control facial care line featuring a moisturiser, wash, scrub, mask and targeted treatment.

An interesting spin on the fatigue-fighting claim, according to Lauder’s Ferguson, surrounds colour cosmetics and “how foundation and concealer come into that to help with hiding the visual signs of fatigue”.

But, when it comes to colour, Ferguson emphasises that “men don’t want to be caught out”. The sophisticated modern formulations used in alphabet creams and cushion compacts are “giving [men] the confidence to achieve the desired outcome without the faff and also without the risk of being discovered”.

Mintel’s Libby also believes that the time might be right for subtle male make-up: a more sophisticated attempt to bring colour cosmetics to the mainstream than the rather more niche ‘guyliner’ trend of the noughties. Once again, this is being credited to millennial guys.

She holds up brow products, such as Tom Ford’s new Man Brow Gelcomb, as an example of a product that could have wide-reaching success.

“Younger men are not growing up with deep-set views about what is the norm when it comes to male grooming,” she concludes. “And the fact that they are coming in with that mindset is very beneficial to that market.”