Market overview: At a glance

What's in this report?

Introduction

Top 5 trends:

1. K-beauty

2. J-beauty

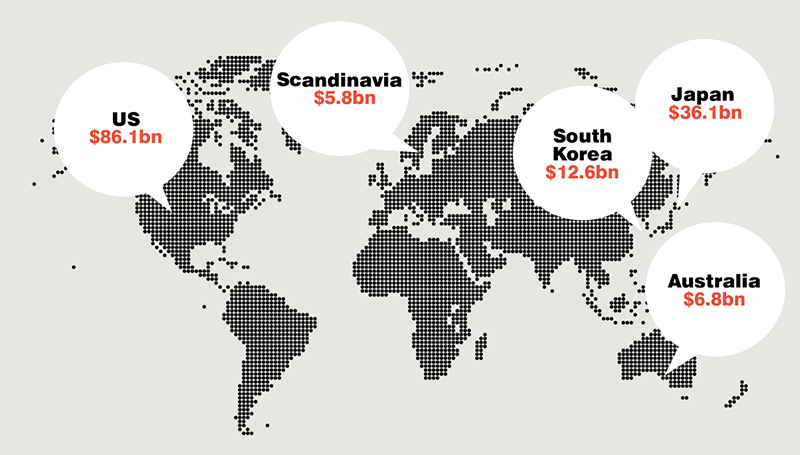

Beauty Hotspots: Market Sizes, 2017

Key market challenges addressed

The meteoric rise of K-beauty has not only shown the cosmetics industry that a destination-based movement can become a worldwide beauty phenomenon, it has also demonstrated that being part of a ‘beauty hotspot’ scene can bring dazzling success for brands.

The past year has seen the growth of other beauty hotspots around the world, including the rise of Japanese beauty, or J-beauty as a global influence in 2018, and a renewed focus on Australian and Scandinavian beauty and even the new wave of American beauty brands.

Yet Ju Rhyu, founder and CEO of New York-based K-beauty consulting company Inside the Raum, says for brands looking to play into any one of these ‘destination’ type movements, there are some significant risks.

“The downside, in my opinion, is that it really limits brands’ potential. These destination movements are niche and the brands that attach themselves to them get typecast. They also get lost among the many other brands that are playing in the destination movement.”

Other challenges include having to respond to rapidly changing consumer demands, says Mark Smith of The Spa Man. “Face masks were a small category before the boom time from K-beauty.

The market did respond and sales rocketed. However, in a year or two this demand is waning as we turn our attention to J-beauty,” he notes. BB and CC creams are another case in point. “They were the key product launches a few years ago, yet it’s rare to see a new one on the market in 2018,” says Smith.

Yet there are also some significant advantages in being part of a beauty hotspot scene. Rhyu says: “I think ‘beauty hotspots’ is an easy thing for consumers to grasp in a very crowded environment. It’s an easy way for retailers to categorise and market their products. And it’s a great talking piece for influencers and editors.

“For small, niche brands, it can help them attach themselves to a bigger movement and get recognised much more quickly than if they went at it alone. They can get consumers and retailers alike to try their products and put them on-shelf because they are ‘K-beauty’ or ‘J-beauty’, for example.”

Beauty hotspots can also provide a platform for new product formats, trends in ingredients and specialised products, while they can be helpful for brands that need inspiration and can respond quickly. “If they have a short NPD turnaround time, it’s a dream,” he says. “They can respond and launch products to suit the market,” says Smith.

They can also boost exports from the home territory. “In some instances, the export market for a brand will be larger than retail in the home market. Given that the population of Australia is around 25 million, exporting to Europe or Asia ensures that you have a larger pool of consumers to sell your products to,” explains Smith.