This article was originally published in Cosmetics Business’ Beauty Hotspots Trend Report. Receive your copy here

Whether it’s K-beauty’s infamous ‘glass skin’ trend or Arab beauty’s oud-based scents, the influence that beauty hotspots such as these – plus Scandinavia, India, Taiwan and more –

are having on global beauty trends is phenomenal.

But they influence more than just trends – they shift expectations. So says beauty industry consultant and strategic advisor Sam Murton, who explains: “K-beauty reshaped routines and normalised high-function skin care. “Scandi beauty brought minimalism and skin wellness to the fore. “Arab beauty has brought new emphasis to pigment intensity, longevity and tradition-meets-innovation.

“These regions act as R&D accelerators. Their influence often starts niche, but when global retailers and social platforms pick it up, the impact is fast and far-reaching.

“They’re changing not just what people buy, but how they think about beauty in terms of structure, efficacy and ritual.”

Not only are beauty hotspots becoming an established concept within the beauty industry, they are growing more important, for multiple reasons.

According to Michael Nolte, SVP Creative Director at Beautystreams, it is a reflection of the fact that the global beauty landscape is no longer shaped by one or two dominant markets.

Where global innovation once flowed from a few Western hubs, this model is dissolving and the beauty landscape, “is becoming fully polycentric,” says Nolte.

“Consumers today are inspired by a mosaic of cultural perspectives, and each region brings its own blend of heritage, innovation, and identity-driven beauty.

“This decentralisation reflects broader cultural shifts: rising economic power in emerging markets, the globalisation of social media, and a growing desire for culturally-rooted

storytelling,” he explains.

And never has the demand for culturally-rooted storytelling been higher. K-beauty’s skin-first philosophy, where healthy skin is the foundation of beauty, or the Middle East’s use of oud to symbolise luxury, as one of the world’s most expensive and rare ingredients while also associated with spiritual connection and the story of Arab culture, resonate increasingly with consumers today.

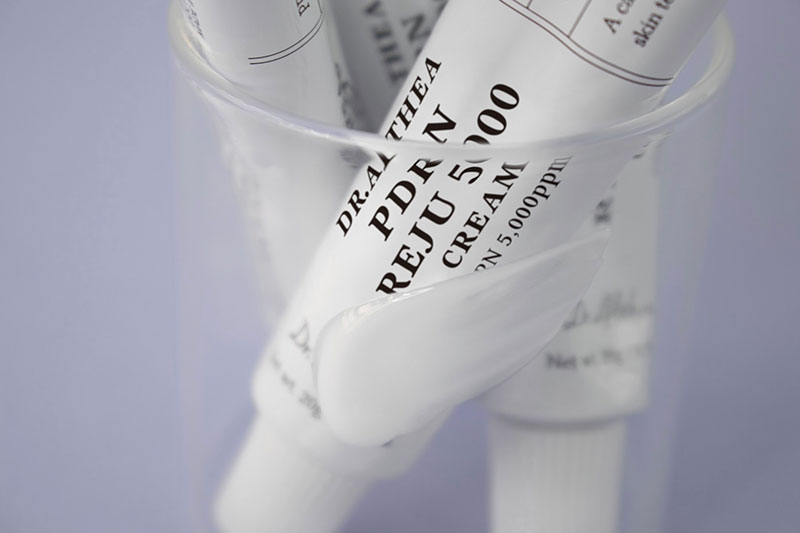

K-beauty is driving the innovation trend in PDRN

Jill Weir, NPD and Brand Consultant at White Label Thinking tells Cosmetics Business: “In an uncertain world, and when surrounded by fake news and AI, I think we are increasingly looking for more authenticity and provenance in our beauty products.

“The more these hotspots become specific and localised – even if thousands of miles away from us – the more credible they are and the more we are drawn to them.”

In addition, regional hotspots are rising because beauty is shifting from universal standards to hyper-personalised needs.

Nolte explains: “Consumers no longer want generic solutions; they want products designed around their skin tone, climate, lifestyle, and cultural rhythms.

“South Korea, India, Japan, the Middle East, Scandinavia, and Taiwan all offer context-specific beauty solutions designed for humidity, extreme heat, cold climates, melanin-rich physiology, sensitivity, or ritual-based routines, making them perfectly positioned for a personalised global future.”

In this way, regional movements can provide international consumers a chance to explore ingredient stories, new textures and rituals that offer functional performance while resonating emotionally.

And that’s exactly the sort of innovation we are seeing.

PDRN – with its ability to repair and restore the skin by promoting collagen production – is central to much of K-beauty’s skin care product development currently – and taps into the

trend for regenerative skin care that is based in real science.

Recent launches include Dr. Athlea’s PDRN Reju 5000 Cream, designed to calm, hydrate and restore skin resilience, with a vegan PDRN derived from probiotics.

As beauty ‘hotspots’ continue to grow and make a mark on the global beauty landscape as they tap into consumers’ evolving needs, the opportunities for brands that align with them are clear.

They can inspire new ideas, whether that’s across ingredients and formulation, traditions and routines, or specialist knowledge in anything from product textures to packaging, resulting in a richer, more diverse and deeper experience of beauty.

Trends will be revealed in detail throughout February exclusively to subscribers, so don't miss out and subscribe.

Trend 1: Arab beauty

Kohl smokey eyes, thick eyebrows, hair extensions and perfume rituals signature scents such as oud, amber and musk – the Middle Eastern beauty aesthetic has become a mainstream and aspirational beauty ideal globally.

But Arab beauty – or ‘A-beauty’ – is just getting started. Its influence is extending beyond aesthetics to ingredients, textures, product performance and storytelling, and experts are betting on the region becoming the next global powerhouse – following in the footsteps of K-beauty.

Mai Nguyen, Creative Director and Marie Duvivier, Head of Consumer Intelligence at trend forecasting agency Perclers Paris comment: “To us, A-beauty is indeed ‘next in line’ – not in the sense that it just popped up out of nowhere, but because it feels more relevant today than it used to and is under the spotlight, much like the Middle East more broadly in the worlds of fashion, beauty, and luxury.”

Trend 2: K-beauty

K-beauty has reigned in recent years, bringing glass skin and snail mucin into the mainstream globally.

It is no wonder that South Korea’s cosmetics industry exports reached a record US$11.43bn globally in 2025, up 12.3% compared to 2024, and the country surpassed France as the biggest cosmetics exporter to the US.

Now, a fresh wave of innovation from Korea is poised to take hold in 2026, spanning hair care and colour cosmetics to boundary-pushing, skin-loving ingredients.

From greater shade inclusivity to spicules, this trend reveals four new K-beauty trends for 2026.

Trend 3: Indian beauty

Indian beauty brands – collectively dubbed ‘I-beauty’ – have been a long-time choice for health-conscious consumers who appreciate many brands’ incorporation of Ayurvedic ingredients and rituals.

However, new focus on cutting-edge skin science, climate-conscious formulations and winning over India’s tech- forward Gen Z have resulted in I-beauty drawing international

attention, in addition to a devoted local consumer base. “I-beauty is evolving,” notes Vivek Sahni, founder of Kama Ayurveda, a luxury skin care brand which blends Ayurvedic wisdom and modern science. “Today’s Indian consumer is more aware and demanding, and seeks tradition with the guarantee of efficacy. What we are seeing is a fusion of ancient and modern.”

Trend 4: Scandi beauty

More than a minimalist aesthetic, Scandi beauty has matured into a much more rounded concept that aligns with what global consumers are looking for today.

“Today, Scandi beauty is less about ‘minimalism’ in the traditional or aesthetic sense and more about a cultural approach to beauty,” says Johanna Augustin, CEO and Partner of Swedish creative agency Pond Design.

“It’s rooted in a mindset: clarity, honesty and a deep respect for nature and wellbeing,” says Augustin, and it is “gaining recognition for its holistic brand worlds and meaningful

narratives, making it uniquely relevant on a global scale.”

This is demonstrated by the success of many newer beauty brands from the region, including Mantle, Estrid and Scandy, as well as longer established players Maria Nila, Lumene and Ole Henriksen.

Trend 5: Taiwan beauty

As a regional beauty movement, T-beauty may not be on consumers’ radars in the way that K-beauty is. But Taiwan is emerging on the global beauty scene as it gains recognition for its dermatological and scalp care brands, novel make-up innovations and technical precision.

Eric Chen, founder of Taiwan-based scalp and hair care brand Aromase says: “Taiwan’s beauty industry has quietly evolved from an OEM manufacturing powerhouse into a creative ecosystem driven by biotech, dermatology, and sustainability”, adds Chen.

“The rise of dermatological and scalp care brands from Taiwan reflects a deeper cultural mindset – one that values preventive care, ingredient transparency, and green innovation.

“This transformation has positioned Taiwan as an emerging innovation hub in Asia’s professional beauty segment, bridging medical expertise with eco-responsible consumer values.”