Making business decisions based on consumer liking is not enough. Pippa Bailey examines the role of colour and fragrance in creating emotional promise and driving perceived functional benefit within personal care

In personal care, as in most markets, it is increasingly the case that most products are fit for purpose. So when the efficacy of a product is taken for granted, the consumer’s attention takes greater account of the subtleties of the sensorial experience and how these reinforce or detract from the emotional experience being communicated by the brand. A positive experience can create a loyal repeat buyer whilst a negative experience can lead to the consumer switching to another brand. The challenge for market research companies is to help personal care brands and their ingredient suppliers select the best formulations to deliver an experience that matches the brand promise.

In the past, much emphasis has been placed on consumer liking ratings to help guide business decisions on which product characteristics or variants are taken forward. This measure is of course important but the continuing high failure rate of NPD demonstrates that it has not been enough to assess the power of a new or revised product to displace existing behaviour and drive success. There is a need to go beyond liking.

Perception and conceptualisation

We have led a number of research projects and developed some distinctive methods which can directly aid brand owners (marketers and R&D teams) and their suppliers to link their product formulations to their brands using expert sensory and consumer research as the starting point. Our approach is based on understanding how the product and consumer interact. In other words, how do consumers take in a product’s sensory characteristics and what do those sensory characteristics mean?

When we encounter products through our senses, we go to our memory and we compare the incoming messages with what’s already stored there. Through this process we come to recognise what things are. We call this ‘perception’. Then we attach meaning to this sensory input, again based on previous experiences held in the memory. For example in shampoo a coconut fragrance may suggest moisturising, tropical, natural and no nasty chemicals. It may also suggest better for the environment. A clear liquid may suggest gentle, simple, carefree and uncomplicated. A thick liquid may suggest enriching, luxurious, indulgent and a treat. This attached meaning helps us create rules helping us make sense of the world around us. We call this ‘conceptualisation’.

Some of what we conceptualise about a product will have functional connotations. For example, if it feels creamy (perception), it will be gentle and protect hair from sun damage. In the same way, some of what we conceptualise will have emotional conceptualisations, eg an exotic smell (perception) – it will make me feel calm, free and happy.

These conceptualisations, or attached meanings, which are essentially non-conscious, allow us to absorb a huge amount of sensory stimuli and immediately process this in order to make choices. So as a formulator or marketer the decision to go with one variant over another – be it colour, fragrance or texture – is not without consequence for conceptualisations and hence ultimate customer satisfaction.

Experience has demonstrated that it is possible to obtain meaningful emotional conceptual brand and product profiles by employing the following three elements:

• A relevant and carefully selected list of words to describe emotions relevant to the category (we call this an emotional lexicon)

• A series of warm-up exercises with respondents to make them appreciate the sensory differences between stimuli and, more importantly, to open their minds to the notion of conceptualisation

• A way to capture the conceptualisations associated with stimuli without asking direct questions which would cause respondents to over-rationalise their responses

We’ve been involved in some key research that serves to explain how sensorial inputs, translated into conceptualisations, can affect consumer descriptions of the functional attributes of personal care products. The potential of this unlocking approach is of tremendous value to brand owners and ingredient suppliers.

Functional conceptualisations in hair care

The power of accessing functional conceptualisations was clearly demonstrated in a study commissioned by Quest (now Givaudan) in 2009 to understand the cross-modal effect of fragrance in shampoo. In this study an extensive consumer-based functional vocabulary was developed for four stages of use (neat product, during washing, wet hair after washing and dry hair). A number of different fragrances were then applied to a 2-in-1 base formulation and respondents’ functional conceptualisations were captured at each stage of use via a survey. Results of this study clearly illustrated that the functional conceptualisation associated with fragrance in shampoo had the power to significantly impact the perception of texture in both the product itself and on the hair during washing, when hair was wet and when the hair had been dried [results can be found in Food Quality & Preference 20 (4) p320-328, June 2009].

This highlights the potential to formulate product to exhibit sensory characteristics in one sense which will ultimately impact perceptions in a second sense. So aside from formulating for actual functional benefits (moisturise, build body, colour protect etc), it is also possible to formulate products through the sensory characteristics (appearance, smell and feel) to enhance functional conceptualisations which support the product claims driving satisfaction and repeat purchase.

Emotional & functional conceptualisation in skin care

Building on these findings, a series of studies was conducted investigating the role of fragrance and colour in beauty creams and serums. MMR wanted to investigate the role that even subtle changes in colour can have in impacting conceptualisations. An example is shown in figure 1 for Olay Total Effects Cream. Here respondents conceptually profiled cream and pink versions of the creams in sealed Petri dishes which eliminated the effect of fragrance. The results show that both colours were seen to equally suggest ‘caring’ and ‘trustworthy’ but that the pink more strongly communicated ‘feminine’ and not ‘traditional’, whereas for the cream coloured cream the reverse was true.

When separating out fragrance and colour it was seen that fragrance alone, although impacting functional conceptualisations, had a far greater role in driving emotional conceptualisations. When colour and fragrance were combined there was a stronger impact on functional conceptualisation than fragrance alone.

Conceptual profiling of brand

In a final case study a number of brands and products in the shampoo category were conceptually profiled. The brand profiling showed that consumers held clearly different emotional and functional conceptualisations of the major brands.

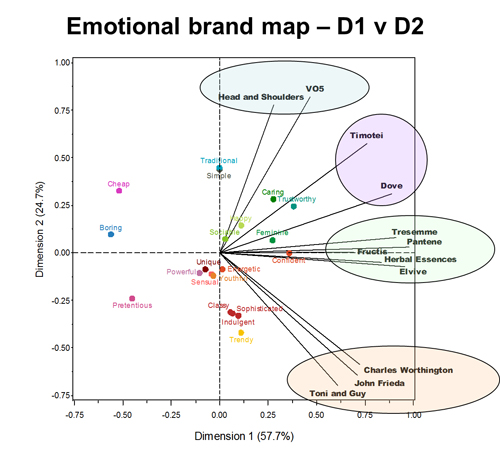

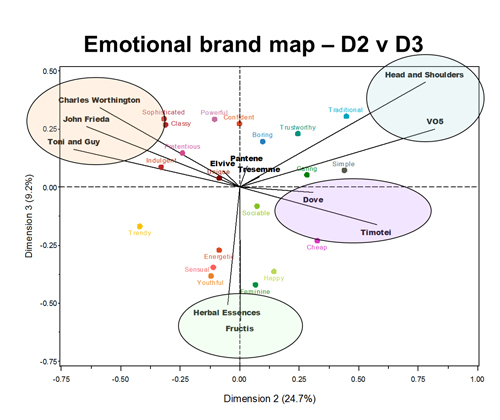

Figures 2 and 3 show that the brands can be divided into five key groups. Head & Shoulders and VO5 are conceptualised as traditional and simple; Timotei and Dove as trustworthy and caring; and the salon-style brands (eg Toni&Guy) as sophisticated, indulgent, classy and trendy. Tresemmé, Pantene, Fructis, Herbal Essences and Elvive are all conceptualised as confident but this group is split out further on dimension 3 (figure 3) where Fructis and Herbal Essences are also strongly conceptualised as being feminine, happy, youthful, sensual and energetic.

This research exercise helps us to understand how emotional and functional profiles link together. In this case we saw that indulgent, sophisticated and classy were associated with functional conceptualisations around strengthening, protection and adding volume; traditional and trustworthy were associated with removing build-up; feminine and happy were associated with leaving hair smelling nice; caring and simple with being gentle on the scalp; and cheap with making hair feel lank.

Our senses play a significant role in the meaning we attach to products. This ultimately influences the choices we make. Delivering products that look, smell, taste, sound and feel appropriate for your brand’s emotional promise and your product’s functional promise is key to commercial success. As the bar is raised ever higher it becomes increasingly important for R&D and marketing departments to work together to harmonise brand and product experiences so the brand becomes a symbol for a product which is sensorially unique.

As consumer decision making becomes less easy to access and understand, given the growing importance of conceptualisations in mature personal care markets, so research needs to respond with sophisticated approaches and techniques. If your market research is measuring little more than consumer liking, you are probably already missing out.

Author

Pippa Bailey,

innovation director,

MMR Research Worldwide, UK

Tel +44 1491 824999

Email p.bailey@mmr-research.com

www.mmr-research.com

MMR Research is a specialist research partner for food, drink and personal care companies