What level of impact should you expect when working with a VIP influencer vs a nano-influencer? Is TikTok still the most engaging platform for audiences, or are Instagram and YouTube still in the game?

The 2022 Engagement Rate Benchmark by leading influencer marketing platform, Traackr, provides clarity on these questions by presenting the average engagement rates by platform and influencer tier, across four major beauty categories (cosmetics, skin care, fragrance, and hair care).

Platform and Tier Highlights:

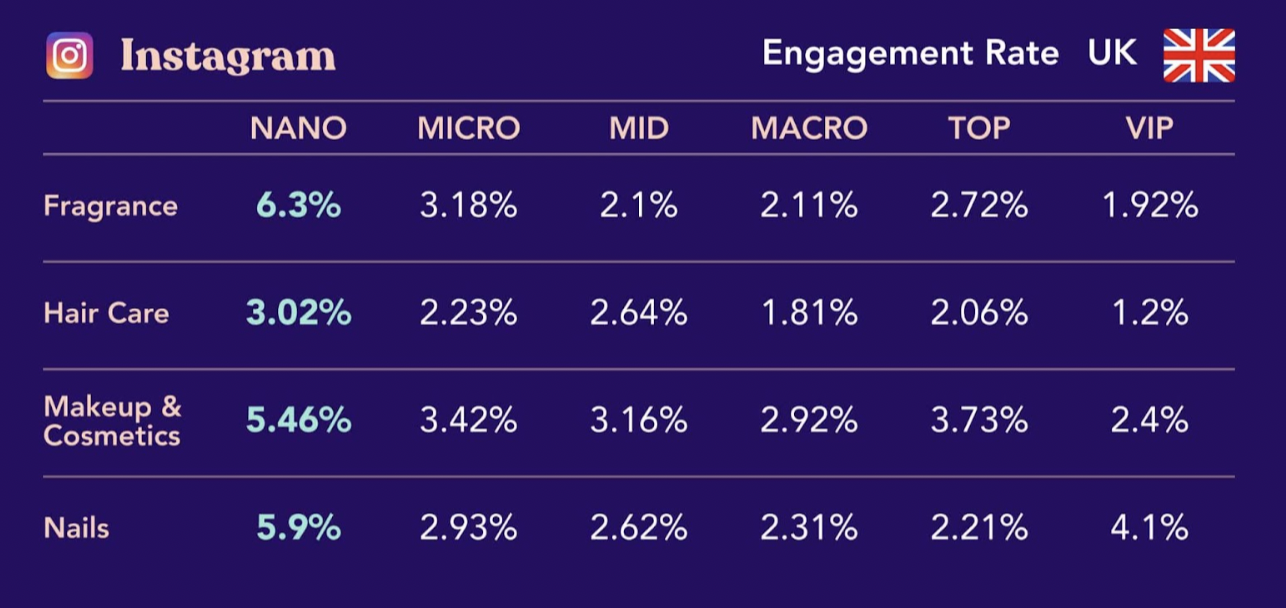

- On Instagram, nano influencers had the highest average engagement rate of all influencer tiers (US, UK, FR)

- On TikTok, micro influencers had the highest average engagement rate in France, while nano influencers had the highest average engagement rate in the US and UK

- In the US, TikTok earned the highest average engagement rate for skincare and hair care, while Instagram still remains king for fragrance and makeup

- In the UK, Instagram is the highest average ER earner for most categories, with the exception of TikTok earning the highest for hair care

- In FR, Instagram earned the highest average ER for all categories except fragrance.

The benchmark also highlights key market trends, examples of top performing branded influencer content, and analyses of strategies from top performing brands like Morphe, Milani, Framar, e.l.f., Makeup Revolution, Olaplex, Beauty Bay, Tarte Cosmetics, and Garnier.

Beauty Trends:

- The rise of TikTok hair care routines? - 2020 was all about the multi-step skin care routine. In 2021 this type of content has seemingly transferred over to hair and scalp care. Micro-influencers won the highest engagement rate for this hair care content on TikTok in the US.

- Satisfying and seasonal Instagram skin care - Influencers and their audiences in the UK enjoy artsy skincare content. Hashtags like #texturetuesday,#texturethursdays, #firstscoop, and #firstscoopfriday are on the rise, denoting content that is focused on showing the ooey, gooey, and creamy textures of skin care products. Another content trend that is on the rise in just the UK - skincare products for different seasons.

- Editorial style makeup - In the US, it seems like popular makeup looks are typically super colourful and creative or natural and barely there. Meanwhile in France, while both of these makeup looks are popular, there’s also a third that captures a lot of attention. Many influencers on both Instagram and TikTok like to create glossy and sleek makeup looks that are highly editorial and glamorous. The colours used are often fairly neutral, but foundation, contouring, eyeshadow, and lipstick is much heavier than a natural look.

- VIP: 5M+

- Top: 1M+

- Macro: 500K+

- Mid: 50K+

- Micro: 10K+

- Nano: 1K+

Brand insights include a deep dive on Morphe’s three-pronged VIP strategy, Milani’s people and price inclusivity, Garnier’s fun TikTok strategy, and more. To download the full report, click here

Methodology

This report was created by Traackr, the system of record for data-driven influencer marketing, through deep influencer, campaign and market-level analysis. For the purpose of this study, we analysed 75,560 influencers primarily located in the United States, United Kingdom, and France who produce content mentioning 1,413 brands from our Beauty Brand Leaderboard. Influencers of all tiers (nano, micro, mid, top, and VIP) were included. We analyzed the content produced and shared by these influencers from January 2021 - November 2021.

For the purposes of this study, we defined influencer tiers based on total audience size across all platforms as follows:

If there were not a significant number of posts in a given category and country on one of the platforms, we excluded the data. Traackr works with brands around the world, some of whom are mentioned in this report, not all brands referenced are Traackr customers.