THG CEO Matthew Moulding has given up the power to veto hostile takeover offers as part of a wider plan for the company to join the FTSE 250.

The founder has transferred his ‘Special Share’ rights, which allowed him to halt any hostile takeover approaches of the British beauty and fashion retail group.

The ‘Special Share’ will be cancelled by THG.

It is part of a strategy to move the company off its standard listing so THG can join the FTSE 250 premium segment of the London Stock Exchange.

The timing of the move, however, is subject to the final outcome of the Financial Conduct Authority’s (FCA) review for reform of the listing regime.

Moulding also gave up his THG chairmanship last year following corporate governance criticism from the media and the city.

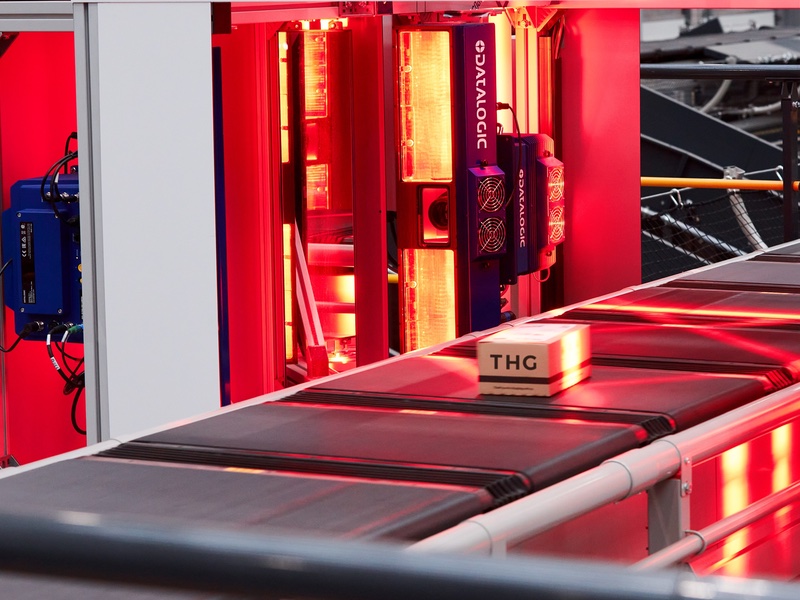

THG wants to join the ranks of the FTSE 250

It has not been plain sailing for THG lately, with an alleged shareholders revolt said to be on the cards.

The anticipated rebellion is believed to be over CFO Damien Sanders’ proposed salary increase, for which shareholder advisory firm Glass Lewis said there was no “compelling justification”.

Last month, the retail group also ended talks with US buyout firm Apollo Global Management over its preliminary takeover proposal.

The retailer’s board rejected the offer based on an inadequate valuation of the company.

It stated there was “no longer any merit” in continuing to engage with Apollo.

Moulding also hit back at the media’s negative press coverage of the company during this time, which he claimed aimed to impact share prices.

Cosmetics Business has reached out to THG for comment.