Market overview: At a glance

What's in this report?

Introduction

Top 5 trends:

2. Teens

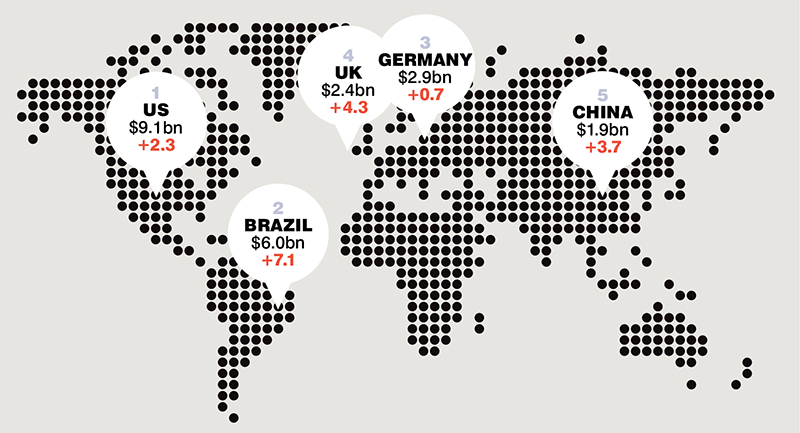

Global top 5 Largest Men's Product Markets

Source: Euromonitor International

Key market challenges addressed

After several false starts, men’s beauty and personal care seems to be finally coming of age, and this time, it feels genuinely different.

Attitudes are markedly changing, usage is being normalised and men have become more knowledgable about products.

“The taboos are slowly dropping, and a growing number of men are using anti-ageing serums and masks, beauty devices and even make-up,” says Naira Aslanian, Report Manager of Kline’s US Male Grooming Market Report.

Men are also looking for more sophisticated products, and new brands such as House 99, Scrubd and Stoer are bursting onto the scene to meet their requirements.

Lucie Greene, Worldwide Director of JWT’s Innovation Group, says: “There has arguably never been more opportunity, especially as direct to consumer brands like Harry’s and Dollar Shave Club create new models of consumption and scale very quickly.”

But equally, this means increased competition for the established, leading brands. “What’s clear to the traditional players is that new competitors can leap from nowhere,” says Greene, “especially in categories which are regularly replenished like deodorant and razors which lend well to subscription models.”

“Some of the established brands have had it their own way for a long time,” says Steven Banks, co-founder of London-based men’s beauty retailer Beast. “Maybe now is the time for younger, more agile brands to break through.”

“What’s clear is that men are no longer buying into clichés and heavy handed promises,” adds Greene. In this new wave of men’s beauty, brands that move away from stereotypical communication and product design, and instead place the emphasis on results and performance instead of gender, are expected to win.

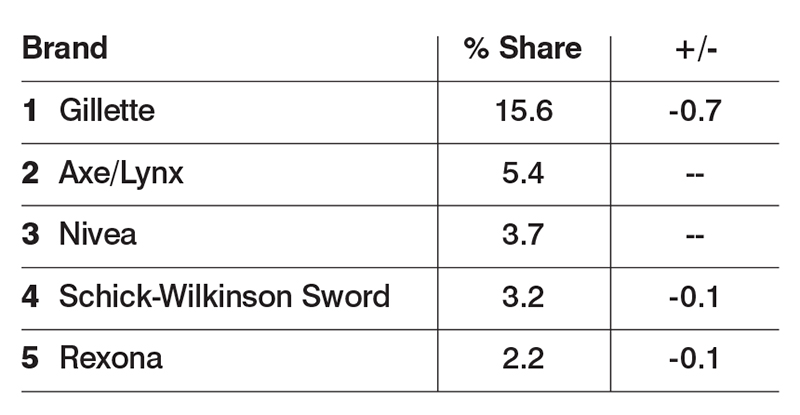

Men's Personal Care Brands, 2016

By retail value, 2016 vs 2015. Source: Euromonitor International