Market overview: At a glance

What's in this report?

Introduction

Top 5 trends:

5. 3D printing

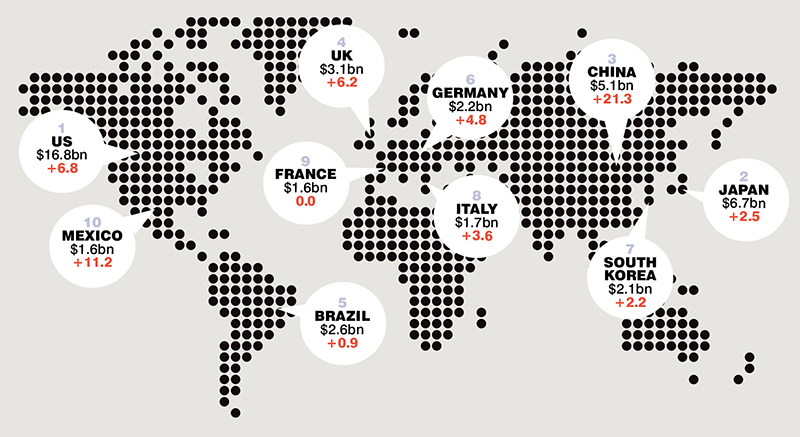

Top 10 colour cosmetics countries by size, 2017

Key market challenges addressed

The disruption of digital technology on colour cosmetics has been enormous. Consumers experience and discover brands and trends in new ways, and brands need to listen far more carefully to them, and respond rapidly.

“The colour cosmetics industry has moved to a very fast-paced world where the consumer is looking for the latest trends immediately,” says Glen Anderson, Executive Director and Global Colour Category Product Development Lead at Avon.

“The biggest challenge for brands right now is to reset how they operate to become more agile, delivering new shades, finishes and forms in alignment with these trends as quickly as possible.”

The runaway success of niche brands such as Pat McGrath, which was last month valued at $1bn, and Kylie Cosmetics, which raked in $420m in its first 18 months, as well as brands such as Charlotte Tilbury, Huda Beauty, Milk Makeup, Beauty Pie and Anastasia Beverly Hills, has created intense competition for established and heritage colour cosmetics brands.

Anderson says, “A number of niche brands have had success recently, as they have been able to react very quickly to the latest trends with new innovations addressing a specific target.”

The challenge for existing brands is to “develop a ‘startup’ mentality where they work outside existing processes to react to trends and deliver products to market sooner,” says Anderson.

Nigel Lawmon, Commercial Director at Feelunique, believes that to win back market share the luxury designer brands need “to listen to their customers; develop their brand and products to tailor to what is and will become important to their consumers. They also need to be innovative and nimble: ‘fast beauty’ will be required to keep up with these small and agile brands.”

Laura Giffard, founder and Client Director of Perq Studio adds: “Big brands need to rediscover their authentic brand narrative. Simply being ‘luxury’ and associated with a culture of opulence is no longer going to cut it: customers want brands that reflect their own stories and lifestyles, embracing individuality and diversity.”